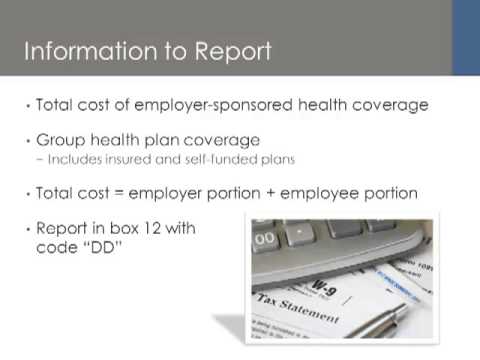

Welcome to our presentation on healthcare reform. Today, we're going to discuss the W2 reporting requirements imposed by healthcare reform on employers. My name is Erika Storm, and I'm an attorney with extensive experience in employee benefits and employment law. I also specialize in healthcare reform compliance for employers and health plans. The healthcare reform law enacted in 2010 contains a new reporting requirement for employers. Under the new rule, certain employers will be required to report the total cost of health plan coverage they provide to their employees on the employees' W-2 forms. Before we talk about the rule, let's get one important thing straight: the new W2 reporting requirement is just that, a reporting requirement only. The purpose of providing this information is to provide useful and comparable information to employees on the cost of their healthcare coverage. Including the value of the coverage on the W-2 form does not make the coverage taxable to the employee, and the value of the coverage is not included as income to the employee. There have been several changes to the compliance dates for the reporting rule. The IRS made reporting optional for all employers for the 2011 tax year. Reporting has also been delayed until at least the 2013 tax year for small employers that filed fewer than 250 W-2 forms in the prior year. However, reporting is mandatory for large employers for the 2012 tax year, which means the information will need to be reported on the W-2s that are issued in January 2013. Which employers must comply with the new W2 reporting requirement? The answer to this question is most employers unless an exemption applies. If the employer provides applicable health coverage to its employees, it will need to report the cost information on the W-2 forms. Along with private employers, the rule...

Award-winning PDF software

W2 box 12 dd Form: What You Should Know

Do I need a paper Form W-2 for my employer-sponsored health coverage report? Yes, a paper Form W-2 is required. I filed my W-2 and my employer reported my coverage of a group health care plan on my Form W-2 using code DD on Form W-2 PDF. This information should be available on the employer, or you should call them as a reference. In most cases, the employer will forward this figure to you as proof of your employee self-insured status, but in some cases this amount will not be returned because the employer was unable to obtain self-insurance. If you did not receive this information, then you should use the paper Form W-2 provided in this publication and send the employer a photocopy with a copy of your tax return. In these cases, you do not need to obtain any further guidance from the IRS regarding Code DD reporting. In some cases, your employer may not be required to provide the same information on Form W-2 as they provide on your individual Tax return. This is a unique situation and is addressed in more detail below. If either of these situations apply to you, and you still need assistance, you can send your questions to the IRS Office of IT Support at. Or, you may contact a local tax professional ate Revenue Solutions at. Back to Top What can my employer do to obtain the information from my Form W-2? If your employer is unable to obtain Self Assessments of Coverage, they should determine whether it was the employees who covered the covered health care services. (This is known informally as Employer ERS) They should confirm whether their employee reported self-paid premiums for individual coverage and the required premiums. If the employer was unable to resolve either of these issues, they should report the coverage on Form 1099-Q as follows: In most cases the employee will receive the premium amount at or after Form 1099-R. If the employer is not able to reach an agreement with the employee on Form 1099-R, they should obtain verification of self-pay coverage on Form 1099-MISC.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions W-3 (PR), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions W-3 (PR) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions W-3 (PR) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions W-3 (PR) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W2 box 12 dd